For instance when you onboard a new client you want to discuss payment terms right from the jump. Heres a look at how accounts receivable works and how it factors into the cash flow accounting of a company.

What Is Accounts Receivable Aging Report And How To Use It

Accounts receivables are also known as debtor trade debtors bills receivable or trade receivables.

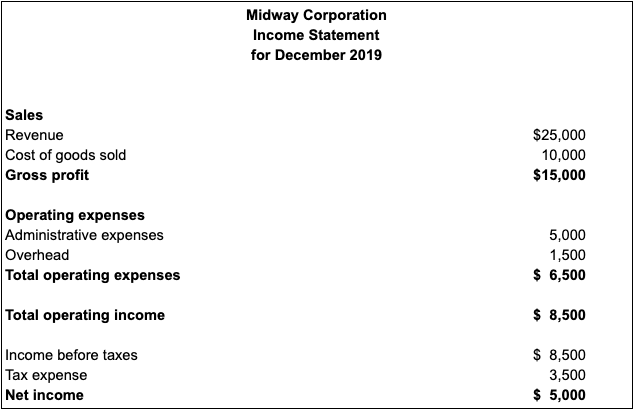

A fresh look at accounts receivable. For example if your AR at the end of a year is 12000 and your gross revenue for the year is 100000 DSO looks like this. The accounts receivable turnover ratio is an efficiency ratio that measures the number of times over a year or another time period that a company collects its average accounts receivable. Dividing 365 by the accounts receivable turnover ratio yields the accounts receivable turnover in days which gives the average number of days it takes customers to pay their debts.

Users of automated accounts receivable software have reported saving up to 600 hours of accounts receivable time. It wasnt long however that he started tackling process improvement. An accountant doing a fundamental analysis of a business would look at how often the business managed to collect on its accounts receivable balance.

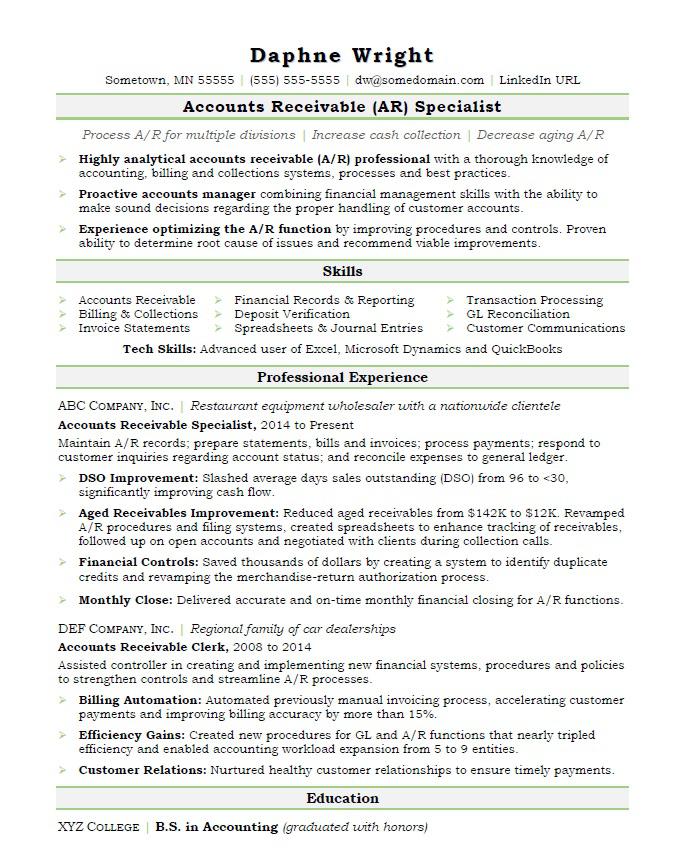

Youve probably used Accounts Receivable without even realizing it before. A bachelors degree in finance accounting or business will expand your options even moreObtaining a certified. At a minimum accounts receivable clerks should have a high school education knowledge of basic accounting principles spreadsheet software experience and a precise attention to detail.

A crucial part of optimizing accounts receivable processes is to start the process early. The special relationship is referred to as the business accounts receivable. You can find accounts receivable under the current assets section on your balance sheet or chart of accounts.

Its best to start the optimization of your accounts receivable as soon as possible. Without a streamlined accounts receivable process you can run into all sorts of problems. Assets include cash on hand cash money in the bank accounts receivable reimbursable expenses inventory and any equipment that is of value.

A Fresh Look at Accounts Receivable. In this case in the form of a future cash payment Whats the difference between accounts receivable and accounts payable. In FreshBooks your outstanding Invoices would be considered accounts receivable.

Experience matters a lot Going for an experienced person might be recommended as she might be. Valuators look at a companys history of AR to determine how much short-term assets the company can safely dedicate to the acquisition of stock or infrastructure. For example you may mistakenly extend credit to an unqualified customer.

Right heres a have a look at how accounts receivable works and the way it components into the money stream accounting of an organization. Accounts receivable is a crucial part of measuring a companys liquidity. In simple terms this line of credit turns your account receivables including outstanding invoices or money owed into immediate cash for the business.

What is Accounts Receivable. Josh Breeden has had a busy first year as a Staff Accountant in UVAFinance. Accounts receivable processing perhaps through a centre of excellence which develops and enforces common practices and standards.

In other words it is the amount that your customer owes you in respect of contractual obligations. That means the customer owes a debt. What Qualities You Should Look For While Hiring An Account Receivable Specialist.

It typically ranges. Getting a new customer on board with electronic payments early in the. Money that is owed to a company for providing a service or good.

It is typically recorded. If you work a job that earns a paycheck then. For instance by adding working.

A new graduate of James Madison University Breeden started in October 2015 diving into his new role learning the ropes and adapting to the culture. These items are a great starting point for the Assets section of your Balance Sheet. Accounts receivable refers to the amount that a company is entitled to receive from its customers for goods or services sold on credit.

First you have to gather a list of those that need to receive a past due notice welcome letter or invoice. On the balance sheet accounts receivable reside under current assets Due to accrual basis accounting the transaction has already occurred on paper even if the funds arent present in the bank. This article is more than 9 years old.

The simplest way to calculate DSO is. All too often businesses are so intent on making sales that they treat accounts receivable as an afterthought. On the stability sheet accounts receivable reside beneath present belongings Resulting from accrual foundation accounting the transaction has already occurred on paper even when the funds arent current within the financial.

Accounts receivable or receivables represent a line of credit extended by a company and normally have terms that require payments due within a relatively short time period. Check hisher qualification It is obvious that before hiring an account receivable specialist you should check that whether a person is eligible for the job or not in terms of educational qualifications. Accounts receivable are classified as an asset because they provide value to your company.

Accounts receivable financing allows small businesses to receive funding for their business and other expenses while waiting for their invoices to get paid. Youll have more AR clerk opportunities with an associates degree or technical school certificate. Accounts Receivable is an asset account on your balance sheet that literally means money that has not yet been received such as something bought on credit or something that is billed basically any payment method except cash.

Then you need to find out the customers specific information and gather any supporting documents. Starting the process early means discussing things like payment terms in the early stages of the customer relationship. Similarly by automating processes you can eliminate manual data entry errors and reduce transaction times.

Accounts receivable at the end of the period Gross revenue for the period x Days in the period DSO. Waiting too long will only complicate things. Adopting key performance indicators KPI and defined metrics is also important.

Consider the amount of time it takes to send an email. What Is Accounts Receivable Financing.

How To Read Your Medical Practice S Accounts Receivable Aging Report And Why It S Important To You Medical Billing And Coding Medical Practice Medical Practice Marketing

Past Due Bill Template Bill Template Invoice Template Collection Letter

Best Practices For The Accounts Receivable Process Lucidchart Blog

Accounts Payable Clerk Resume Sample Job Resume Examples Sample Resume Format Accountant Resume

Top 10 Accounts Receivable Specialist Interview Questions And Answers

Best Practices For The Accounts Receivable Process Lucidchart Blog

Accounts Receivable Turnover Ratio Tools Examples The Blueprint

Top 250 Accounts Receivable Interview Questions And Answers 18 July 2021 Accounts Receivable Interview Questions Wisdom Jobs India

Accounts Receivable Meaning How To Report And Analyze It Penpoin

When Not To Use Factoring Of Accounts Receivable Coral Capital Solutions

Schedule Of Accounts Receivable Template Sansurabionetassociats Throughout Accounts Receivable Report Template Report Template Accounts Receivable Templates

Accounts Receivable Resume Sample Monster Com

Accounts Receivable Examples Definition Investinganswers

Power Bi Finance Dashboard Account Receivable Ar Solution Demo Video Finance Dashboard Power Bi Power Bi Dashboards

Accounts Receivable Clerk Best Resume Examples Myperfectresume

Accounts Receivable Questions That Cry For Quick Answers Recoupera

6 Best Ways To Effectively Manage Your Accounts Receivable Accounts Receivable Accounting Notes Management