Service sector has acted as a major force for the growth of Indian economy. To maintain the single-stage principle manufacturers would be entitled to an exemption on sales tax paid on their raw materials and other input to production.

Climate Change Implications For Cities Climate Adaptation Climate Change Climate Change Activities

SST is a simple and straightforward tax regime where businesses do not need to spend time and effort on calculating GST refunds.

What is implication of sst on financial. What is a financial implication of churn. Loss of revenue B. Per 2014-15 FY the contribution of service sector in Indian GDP is 52 783.

Broad consensus that this is the right directionBroad consensus that this is the right direction. Financial Implication of strategic management decisions. GST should be charged at 0 on the proportion of the supply made before 1 Sept 2018.

Sales tax is a single-stage tax meaning that it is only imposed at one stage in the supply chain at the import or manufacturers level. - Swiss Solvency Test SST Introduction Solvency II Principles Risk based supervision. What is the implication of SST on financial products services.

As such they can allocate more resources on productive matters which may result in higher sales and profits to their owners. Increased production C. Increased production C.

SST usage creates value for the customer eg. An exception will only be allowed for those manufacturers of taxable goods paid for their raw materials components and packaging materials. 50 Introduction of Implication of SST Starting from 1st September 2018 the new government will impose the sales and.

What is a financial implication of churn. Policies containing more risk are punished by an increase in the required capital. Accounting project topics and materials.

SST may lead to Cascading Rise in Prices. Aug 2018 The Ministry of Finance has announced that 6 of Service Tax will come into effect in Malaysia on 1st September 2018 repealing the Goods and Services Tax GST which was first introduced as 6 on 1st April 2015 and further reduced to 0 on 1st June 2018. Loss of revenue B.

The Sales Tax is a single-stage tax imposed only at one stage in the supply chain ie at the import or manufacturing level. 22 June 2020 June 22 2020 exams Leave a comment. View Essay - implications of sstdocx from FOBAM FIN4343 at SEGi University.

Refer to Proposed Sales Tax Rate for Various Goods for more information. Home Cisco 820-605 What is a financial implication of churn. Reduced product utilization D.

What is a financial implication of churn. Home Cisco 820-605 What is a financial implication of churn. 28 December 2020 December 28 2020 exams Leave a comment.

What is a financial implication of churn. We are experts on Municipal Provincial and National Standard Chart of Accounts. A perception of lack of control over the SST encounter.

Ansoff Matrix Igo Ansoff. Corporate Strategic Decision 1. Reduced product utilization D.

Using the theoretical lens of Service-Dominant Logic an analysis of SST experiences indicates that customers undertake a variety of SST roles such as that of convenience. While the proportion made on and after 1 Sept 2018 is subject to 6 service tax. Such a rate will create adequate disposable income to spur private consumption and in turn business activities he said.

Who is Invictus We are firm managed and owned by Chartered Accountant. Financial implication of internal control system in an organisation a case study of mercury microfinance bank. Understanding the Classification Framework and implication on financial reform.

It is expected to grow at a rate of 74 in FY as compared to. The Sales Tax is levied at the import or manufacturing levels and companies with a sales value of taxable goods exceeding RM500000 in a 12-month period are liable to be registered for the tax which is levied at rates varying from 5 to 10 depending on the goods in question. A sense of accomplishment or destroys value eg.

Is the tax implication on the service provided. We are level 1 BBBEE We are based in the Kwa. Will I be charged RM25 on my existing credit or charge card on 1 September 2018.

Financial implication of Thilakawardhana Textile BS Nisak Ahamed HND in CSD -05 Lecture By - CB Jawahira. Zulu-Natal however we work throughout the country. Exempted from SST registration are tailoring jewellers and opticians.

On the whole the SST is expected to create more disposable income which in turn is expected to boost consumer spending and business activities.

Pdf Product Development In Islamic Finance And Banking In Secular Economies

Steps To Impact Investing Investing Finance Investing Risk Management

Reit Investments Tax Implications In India Real Estate Investment Trust Investing Reit

694 Questions With Answers In Globalization Science Topic

Gst To Sst In Malaysia 3 Key Impacts Explained Infographic

Climate Change Implications For Investors Climate Change Climate Adaptation Climate Change Effects

Malaysia Malaysian Tax Enforcement In 2020 Updates Bdo

694 Questions With Answers In Globalization Science Topic

The Financial Decisions You Make Now Have Lasting Implications For The Rest Of Your Life Here Are Preparing For Retirement Financial Decisions Life Decisions

Gst To Sst In Malaysia 3 Key Impacts Explained Infographic

Tropical Cyclones Impacts The Link To Climate Change And Adaptation Climate Analytics

Tropical Cyclones Impacts The Link To Climate Change And Adaptation Climate Analytics

Assessment Of Psd2 Impact On Banks Business Assessment Financial Services

Tropical Cyclones Impacts The Link To Climate Change And Adaptation Climate Analytics

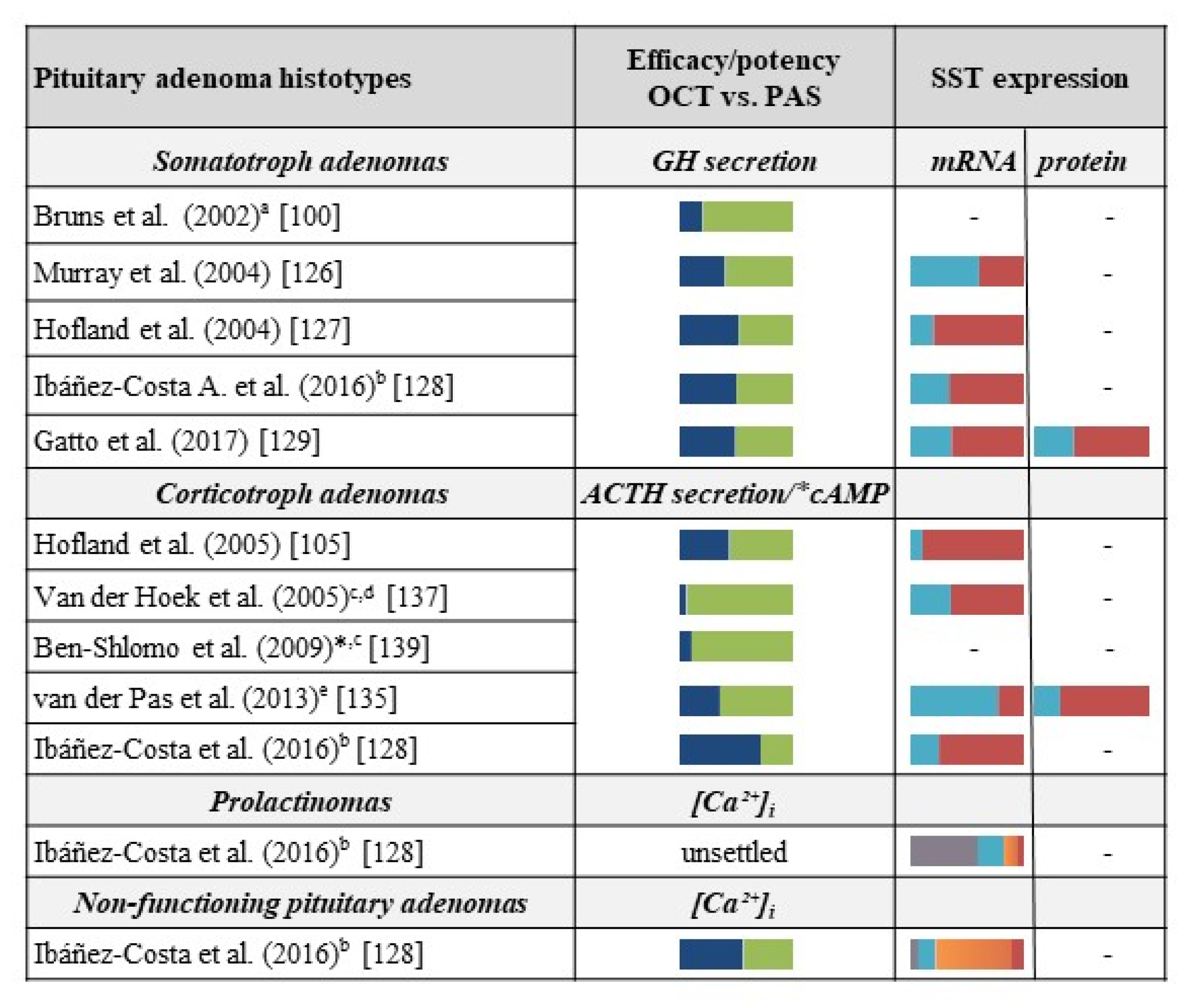

Ijms Free Full Text Biological And Biochemical Basis Of The Differential Efficacy Of First And Second Generation Somatostatin Receptor Ligands In Neuroendocrine Neoplasms Html

Squaring The Survival Curve And Retirement Planning Retirement Planning Survival How To Plan

/SalesforceSocialAudit2017-5c856a1946e0fb0001a0be84.jpg)

/SalesforceSocialAudit2017-5c856a1946e0fb0001a0be84.jpg)