Viele bersetzte Beispielstze mit compliance with tax Deutsch-Englisch Wrterbuch und Suchmaschine fr Millionen von Deutsch-bersetzungen. These factors have been compressed into several modelstheories providing insights into the subject matter.

State Local Tax Compliance Government Contractors Virginia Cpa

A minor reporting or administration error will be much easier to identify where technology is being utilised by tax authorities.

Tax compliance and contracting most. Possible ie to maximise the overall level of compliance with the tax laws. As a result the chances of facing a possible fine or prosecution for a simple error are much greater. Having a cloud-based central repository for all tax documentation also means organizations are less likely to lose track of important tax.

In the face of these concerns as well as ever-changing tax laws and regulations and shortages of tax talent the important business of compliance has become. Maintaining tax compliance is a systematic cycle of six steps. Global tax compliance and reporting Current insight and future trends 7.

This applies with effect from 1 April 2013 to all central government contracts of more than 5 million. The findings suggest the following implications for research and policy action. Businesses and their service providers need to acknowledge that tax compliance change is a systemic issue and therefore maintenance needs to be addressed systematically.

Another big advantage of using this type of software is that it can help companies keep track of differing sales tax regulations across jurisdictions. Tax compliance isnt for the faint of heart these days. Proper execution can directly affect cash flow the defensibility of tax return positions risk management and ultimately the publics perception of your company as a responsible taxpayer.

In order to mitigate the risks and ensure you stay. Individuals who dont complete their tax return filing by this date are considered noncompliant. One of the main benefits of using tax compliance and sales tax software is the decrease in the manual effort it takes to calculate and file taxes.

Tax Compliance Management Systeme. The interest generated by the subject matter of tax compliance behavior has led to identification of several factors that are believed to influence individual tax compliance decision. Brauche ich Tax Compliance.

For this purpose they are appropriated a finite level of resources meaning that careful decisions are required as to how and in what ways those resources are to be applied to achieve the best possible outcome in terms of improved compliance with the tax laws. The top ten federal tax compliance issues for businesses havent changed much in the wake of this reform. Operating models A continuum of sophistication Analysis of our research findings from 2010 and our most recent survey shows that when it comes to tax compliance and reporting operating models global companies do not clearly segment on traditional lines such as industry or geography.

Ein Tax-CMS bietet in mehrerer Hinsicht Vorteile. Turkey is the most complex place in the world for Accounting and Tax compliance followed by Brazil Italy Greece and Vietnam - according to TMF Groups inaugural Financial Complexity Index 2017. For contractors working internationally tax compliance is crucial in order to prevent potential fines or legal action.

Instead we see them spread along. For those looking for opportunities overseas or delivering on global projects from your home country the world of compliance can be a real minefield and individual circumstances can impact your determination in different locations. The most prominent action is taking place with the OECD Organisation for Economic Co-operation and Development which has been tasked by the G20 with recommending wholesale changes to global tax systems to address the double nontaxation issue that can exist because of gaps in the current tax systems.

Mit dem Schreiben hat die Finanzverwaltung erstmals die Relevanz von Tax Compliance Management. The leading provider of global business and compliance services ranked 94 jurisdictions across Europe the Middle East Africa Asia Pacific and the Americas. Suppliers bidding for these government contracts must self-certify their tax compliance.

Its primary duties are to ensure UVAs compliance with all the various tax laws and to manage contracting activities for UVAs central administration and operational units. A basic example here is the annual April deadline for tax return filing. The Office of Tax Compliance and Contracting is located within the Financial Operations area of UVAFinance.

Die Sicht des Bundesfinanzministeriums. We recently covered the cost of tax compliance in this recent articleThe costs are a direct result of how c ompanies face a myriad of tax compliance issues even in the wake of tax reform that is supposed to boost bottom line results. First it is recommended that future studies should seek to develop a few theory based set of relevant determinants of tax compliance that can yield accurate predictions.

Auerdem bietet ein Tax-CMS Schutz vor dem Vorwurf einer Desorganisation des Unternehmens. Overall tax compliance involves being aware of and observing the state federal and international tax laws and requirements set forth by government officials and other taxing authorities. They risk leaving their tax return on the table as well as.

Es gewhrleistet eine Organisation bei der Sie sicher sein knnen dass die geschaffenen Strukturen und Ablufe steuerrelevante Themen angemessen bercksichtigt. 1 being most complex through. Second tax policy makers are advised to.

For contract professionals who are actively taking steps to be compliant in their overseas assignments the increasing use of digital in tax processes does also present a risk. Das gibt Ihnen Sicherheit. This study reviewed five prominent theoriesmodels that have been used to explain compliance via-.

Das Thema Tax-Compliance hat seit Verffentlichung des BMF-Schreibens vom 23052016 zum Anwendungserlass zu 153 AO fr viele Unternehmen stark an Bedeutung gewonnen. BDO works directly with our clients to effectively address their tax planning and compliance needs allowing them. Federal and state income taxes are complex and many organizations must address the additional complexities of local and foreign tax regulations.

There are 6 phases to compliance maintenance. Effective tax planning can be critical to helping government contractors moderate tax liability and optimize profits in a highly competitive landscape. Control variables were on the overall good predictors of tax compliance.

This is the basis.

Sara Hansard On Twitter Payroll Taxes Payroll Tax Refund

Access Denied New York State Small Towns New York

Pin On Law Books For Aspiring Lawyers To Improve Their Legal Skills

Doing Business In The United States Federal Tax Issues Pwc

Construction Accounting Methods For Financial Reporting And Income Tax Reporting

Working For A Foreign Employer Here S How To Report It On A Tax Return

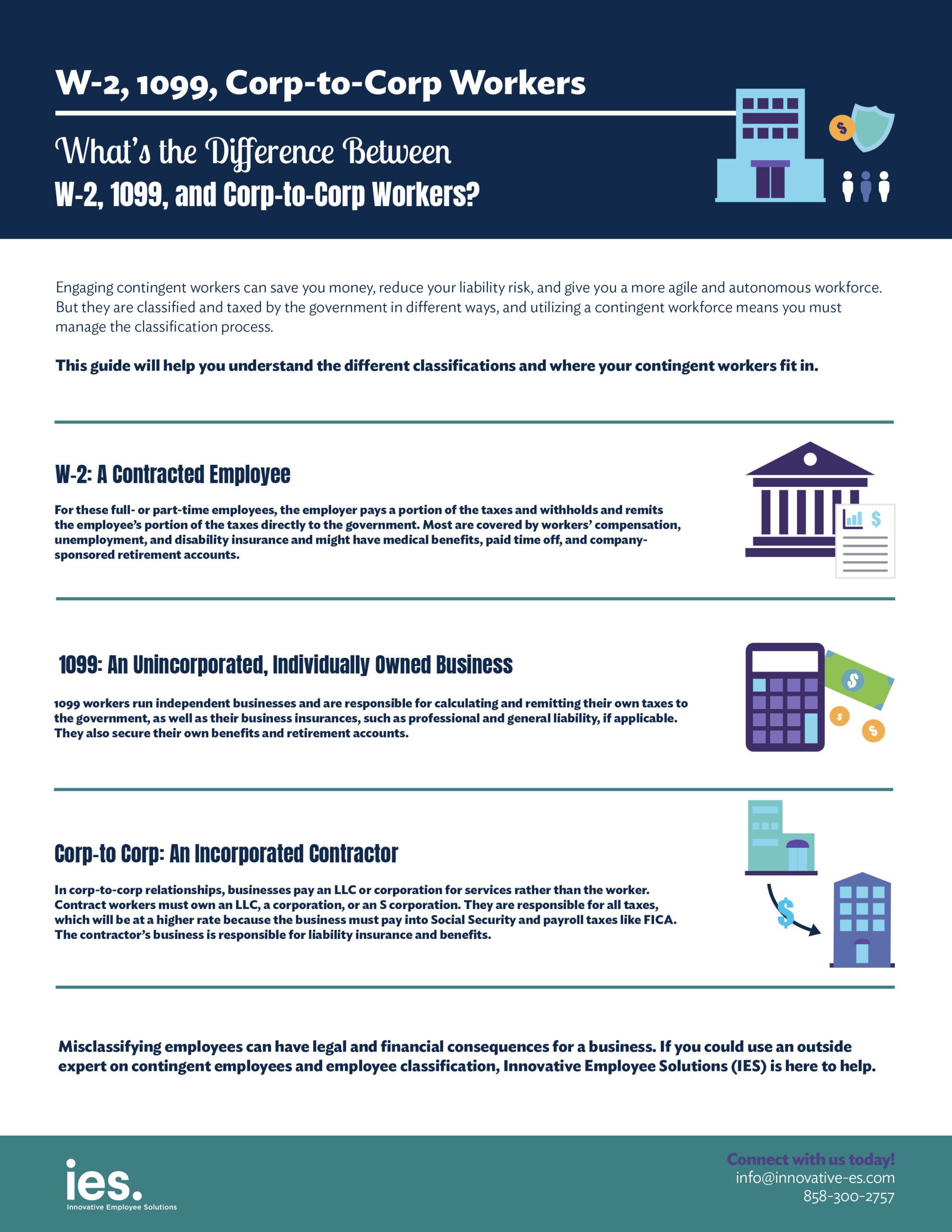

What S The Difference Between W 2 1099 And Corp To Corp Workers

How To Dispose Of Unwanted Personal Care Products Personal Care Care Medicine

Last Call For 2017 Allegheny County Tax Assessment Appeals The National Law Review Allegheny County Forklift Assessment

Dcaa Quick Books And Dcaa Bookkeeping Services Dcaa Accounting Compliance Accounting Bookkeeping Bookkeeping And Accounting

Pin On Contract Management Software

What S The Difference Between W 2 1099 And Corp To Corp Workers

Overview Of Annotations File Cabinet Cs Annotation Quickbooks Tax Software

Contract And Commercial Management Survey Deloitte Us

Should I Be A Contractor Or Employee A Guide For Remote Workers

Business Restructuring Consulting Business Business Services Business

Iim Kozhikode Completes 2018 20 Batch Placements Mean Salary Rises 12 Estate Planning Job Job Search