No theyre not. A revocable trust gives you the option to make changes to it after its signed but depending on its terms it may or may not lead to tax advantages further down the line.

Basically the income of unit trust may consist of dividends interest or profit.

Tax benefits of unit trusts you must. The latter usually start at around R500month. Distributions received from unit trusts are subject to tax in the same way that company dividends are. Tax Benefits of Unit Trusts YOU Must Know Due to Malaysian Governments efforts to promote unit trusts most of the income received by unit trusts will be exempt from income tax.

Basically the income of unit trust may consist of dividends interest or profit and gain from sale of investments and returns on bonds. Tax Benefits of Unit Trusts YOU Must Know. One of the major differences between a will and a living trust is that everything in.

Lump sums are often in the region of R50 000. Ignore the trust in Unit Trust. Like shares the trust where applicable will attach imputation credits.

Monthly investing makes it possible to build a large amount slowly on a limited income. Certain tax implications may arise on the redemption of your unit trusts. This is in contrast to closed-end funds which can trade at deep discounts to the NAV.

The best way to invest in unit trusts is directly through a low-cost unit trust provider. However it may be tax free if it falls within one of the allowances dividend allowance or starting rate for savingspersonal savings allowance. Unit Trusts are PFICs.

The beneficiary has to pay income tax on the proportional profits they derive from the trust. The rules differ from companies to trustees. Posted on January 17 2017 Trusts are traditionally used for minimizing estate taxes and can offer other benefits as part of a well thought-out estate plan.

Or they may decide to distribute the tax liability to the beneficiaries at their marginal rate of tax. The following general comments apply. Trusts can either be revocable or irrevocable essentially meaning that they can either be amended after theyre created or not.

Basically the income of unit trust may consist of dividends interest or profit and gain from sale of investments and returns on bonds. You can invest in lump sums or monthly debit orders. Trusts may provide tax benefits.

Several benefits are derived from this legal document. AAFCPAs advises clients to think about the benefits of establishing a trust as a method to control. Any unit trust held within an individual savings account ISA is free of income and capital gains tax.

Rather the unitholders are taxed on their share of the trust income. The income from unit trusts and OEICs is always taxable regardless of the share class or whether the income is actually taken or reinvested. The NAV of a unit trust may be higher or lower than the initial price paid for the units.

Pooled investment would be subject to PFIC reporting requirements. Ways to invest in unit trusts. For simplicity sake - any non-US.

Creating a trust can help you achieve both of those goals. Charges erode returns so the less you. The units will be bought back at the current net asset value -- NAV -- of the units without any additional fees or commissions.

Similar to a mutual fund a unit trust fund is an investment by a group - which own the assets underlying the trust. Trusts are not normally taxed at all. Although the name may imply as such they are not foreign trusts in the eyes of the IRS.

Will Vs Living TrustThe Differences. Tax Benefits of Unit Trusts YOU Must Know Due to Malaysian Governments efforts to promote unit trusts most of the income received by unit trusts will be exempt from income tax. Basically the income of unit trust may consist of dividends interest or profit.

Unit Trusts-Top 3 Benefits of Unit Trusts Unit trusts in business arise with differently based on the fact of it enhancing general investments schemes that attract investors money then invests it with a specific objective and most importantly managed by a professional fund managerSecurities Commission of Malaysia. Unlike a company a Unit Trust does not have to pay any tax. Unit trusts are designed for ordinary income earners.

Similarly trusts enjoy a 50 Capital Gains Tax discount regarding disposal of assets that can be passed on to the beneficiaries if the trust is structured accordingly. Redemptions by the reverse order or ordering rules will not incur an additional tax liability unless you. The most notable is that it avoids probate which is the bane of a will.

Franking credits will generally only pass through a unit trust if it meets the rigid definition of a fixed trust. Trustees can decide to pay the income tax- which is 45 or capital gains tax- 36 in the hands of the trust. Unit trusts can access the 50 CGT discount but the unitholder must be an eligible entity to retain that concession.

For the current tax year youre allowed to invest up to 20000 within a stocks and shares ISA which would offer the option of investing within a range of unit trusts depending upon your personal attitude to risk. While you are still fully capable you have the benefit of adding to subtracting from or making any changes that you deem necessary or prudent. As discussed above - Non-US.

UIT units are also more liquid than many individual bond issues. Due to Malaysian Governments efforts to promote unit trusts most of the income received by unit trusts will be exempt from income tax. Tax Benefits of Unit Trusts YOU Must Know Due to Malaysian Governments efforts to promote unit trusts most of the income received by unit trusts will be exempt from income tax.

The sponsor of a unit investment trust is required to buy back units of investors who want to sell their units. Income tax is 18 to 45 or capital gains tax 72 to 18 thereby paying much less tax.

Under Construction Vs Sub Sale Properties 8 Things You Need To Know Property Under Construction This Or That Questions

Mutual Funds Archives Ezmart4u Real Estate Investment Trust Mutuals Funds Portfolio Professional

What Is A Balanced Mutual Fund Mutuals Funds Credit Score What Is Credit Score

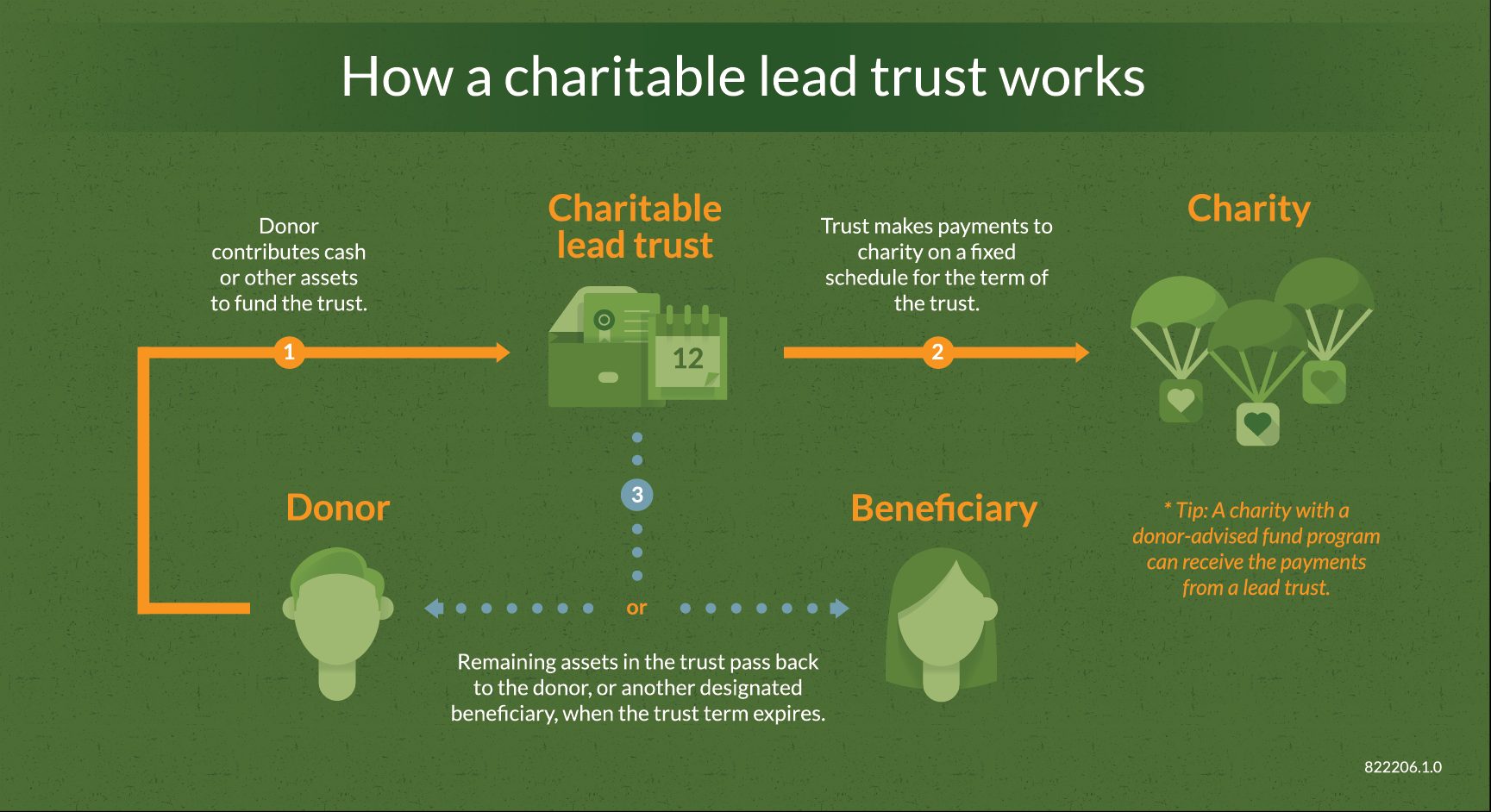

Charitable Lead Trusts Fidelity Charitable

S Should I Buy Stocks Bonds Etfs Properties Gold Or Unit Trusts Etc Which Asset Class Makes The Best Investment I Investing Best Investments Stock Market

A Dummies Guide To Unit Trusts Andreyev Lawyers

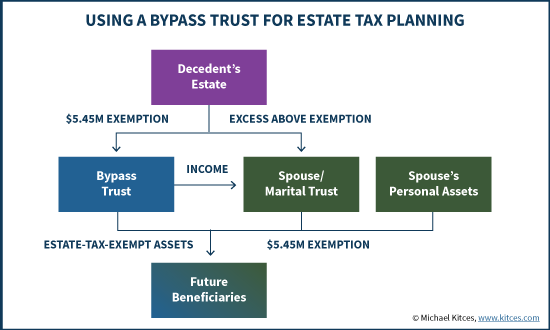

Distributable Net Income Tax Rules For Bypass Trusts

The Benefits Of An Offshore Family Trust The Alternative To A Will Infographic Http Www Assetprotectionpackage Family Trust Trust Fund Safe Alternative

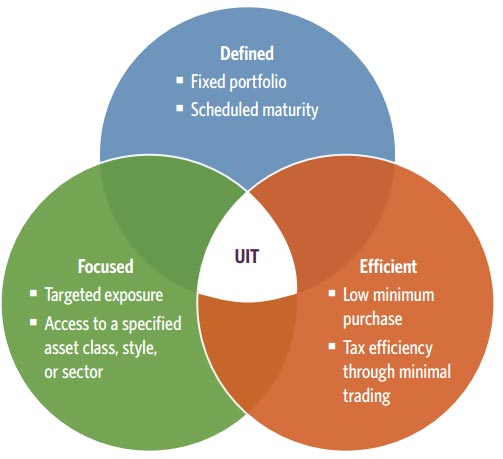

About Unit Investment Trusts Uit Guggenheim Investments

Won T I Need A Large Amount To Invest In Mutual Funds Mutuals Funds Mutual Funds Investing Investing

Know About Tax On Mutual Fund And Taxation Rules Mutual Funds Investing Mutuals Funds Investing

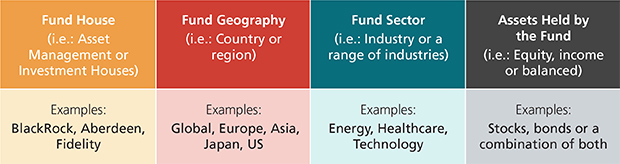

What Is Unit Trust Investment Dbs Singapore

Start Investing Money In Mutual Fund And Grow Your Savings Repleteequities Mutualfund Investment Inve Insurance Investments Mutuals Funds Investing Money

The 721 Exchange Or Upreit A Simple Introduction Estate Planning Capital Gains Tax Real Estate Investor

Taxbenefit In 2020 Wealth Creation Mutuals Funds Investing

Pin By Archana Pamnani On Mutuals Funds Investing In Shares Investing Equity

Infograpic 20 20how 20to 20create 20multiple 20sources 20of 20income Sources Of Income Multiple Sources Of Income Income

Types Of Mutual Funds In India And Which One Is The Best Mutuals Funds Mutual Funds Investing Finance Investing