For credit card holders there is confusion on how GST is being charged. After 1 April 2015 this service tax will be abolished due to the implementation of GST.

Know About Types Of Gst Returns And File Your Return Under The Desired Categoriy Timely Timley Gst Return Filing Gi Credit Card Design Card Design Credit Card

Change your previously chosen GSTHST fiscal year.

Credit card what are changes after gst. Worse yet the interest charges keep accumulating month after. 118 of this document to reflect amendments to the financial supply provisions of the goods and services tax law. End users do not have to pay any taxes on the payment utility bills.

GST Impact on Credit Cards Forget 15 Service Tax Adapt to 18 GST Rate. If you are making only the minimum payments on your credit cards it could take many years to pay off even a small balance. Before the introduction of GST all credit card services incurred service tax at 15 but now this service tax has been replaced with 18 GST on credit cards.

The dominant supply is the theatre ticket or entertainment and the credit card aspect is merely ancillary to the theatre ticket supply in that it enables the dominant supply to occur. After 1 April 2015 this service tax will be abolished due to the implementation of GST. The due date for comments on the draft GSTD has been.

This will be applicable on interest on credit card EMIs processing fees late payment charges annual fees over-limit charges and all other fees and charges levied by your credit card provider. As a temporary measure in response to COVID-19 the CRA will not deduct your GSTHST credit payments to repay tax debts and other government debts including amounts owing due to being ineligible for COVID-19 Canada Emergency or Recovery Benefits. We are still updating issue no.

So if you are a smart user and pay your credit card bills on time there is no way that GST will be levied and your credit card usage will not be affected. Hansmukh Adhia had also clarified this in one of his tweets earlier. In fact the utility bill providers used to pay Service Tax to the card issuers and even this is still the same in GST.

A senior GST Official who participated in a recent webinar of ASSOCHAM on July 23 2020. Credit card users would know that before GST there was no Service Tax levied on the payment of utility bills. Release Plan for revised GST APIs has been postponed to 25th August 2020.

GST is not levied on the total outstanding amount. Over here we are talking about the service tax and annual fee. However the truth is that there would be 18 GST applicable on Late Credit Card Payments but nothing would be charged doubly.

GST Return Filing Changes and Its Impact. Following extensive consultation with the financial services industry on claiming GST credits in a credit card issuing business and in order to provide certainty and consistency on this issue the ATO. But when you pay this amount after the due date it will be levied on the late.

Monthly and annual fees chequebook fees and loan establishment fees. Updated on 13 Aug 2020. They are characterised as exempt supplies under the Goods and Services Tax Act 1985.

Therefore there is a single taxable supply of theatre tickets and the value for GST purposes includes the credit card surcharge. How about the annual fee. When you pay a part of the bill then the Goods and Services Tax GST gets charged and that too on the interest portion.

There were rumours doing round that GST will be levied doubly on credit card transactionspayments once on the Utility Bill and again on the Credit Card Bill. The New Return System is likely to be scrapped as per a recent announcement in one of the ASSOCHAM Webinar. Dr Hasmukh Adhia.

Use a non-calendar fiscal year. GST financial supply provisions. Use a calendar fiscal year.

Revenue Secretary Dr. Inland Revenue have been asked about their position on credit card surcharges GST. The complexity of GST on a credit card is simple to understand.

This fact hasnt changed even in the GST regime. 6 Making Minimum Payments. All credit card services incur GST at 18.

So if the interest charged is 600 the GST at 18 would be 108. Bank fees interest dont attract GST as they are a financial service. To be clear these surcharges should not be confused with the credit card charges levied by the banks on their customers.

Recipients who are single can get up to 451 married couples can get up to 592 plus up to 155 per child under age 19. However 6 GST will be imposed on the credit card annual fee which ranges from RM50 up to RM500 depending on the type of card. Determining the creditable purpose of acquisitions in a credit card issuing business for public consultation.

The CRA can apply your goods and services taxharmonized sales tax GSTHST credit payments to pay tax debts and other government debts. That means an additional rate of 3 percent would have a negligible. You may want to make the following changes to your GSTHST fiscal year.

Maxing out your credit cards also hurts your credit score since creditors look at the amount of credit you have outstanding and how it compares to your total outstanding balance. It does not apply on paying off the entire dues on or before the due date. 12 A wrong message is doing rounds on social media that if u make payment of utility bills by credit cardsyou will be paying GST twice.

Credit Card Surcharges GST. The GST is out and so are the queries related to many products and services which also include the concerns of credit card shoppers. Note GST is charged on credit card merchants.

Dont be worried with the removal of. If you qualify you can make changes to your GSTHST fiscal year online in My Business Account or Represent a Client or by using Form GST70 Election or Revocation of. At the moment the rate of GST is 18.

Currently there is a RM50 service tax on principal card holder and RM25 service tax on supplementary card holder. For the July 2020 to June 2021 payment period that is based on your 2019 net income you will receive GSTHST credits when your family income is less than. As you know that after making a transaction with your credit card you need to pay this amount back within the due date.

Below are some of the more common GST mistakes made by companies that do not have accurate bookkeeping systems in place. Has published GSTD 2018D1. Bank fees are treated as input taxed meaning the bank doesnt charge GST to the customer.

What Is Gst Gst Is A Comprehensive Value Added Tax On Goods And Services It Is Collected On Value Added A Goods And Services Study Materials Value Added Tax

Gst Inspector Received Bail In Illegal Gratification Case By Court Within 7 Days Goods And Services Goods And Service Tax Indirect Tax

Pin On Bankruptcy Proposal Consolidation

Check Out The Purchase Credit Card Fees Charges Hdfc Bank

Gst Helpline India Is An User Friendly Mobile Application It Is Aware Of All Current Update News Articles Related To Gst Mobile Application Mobile App App

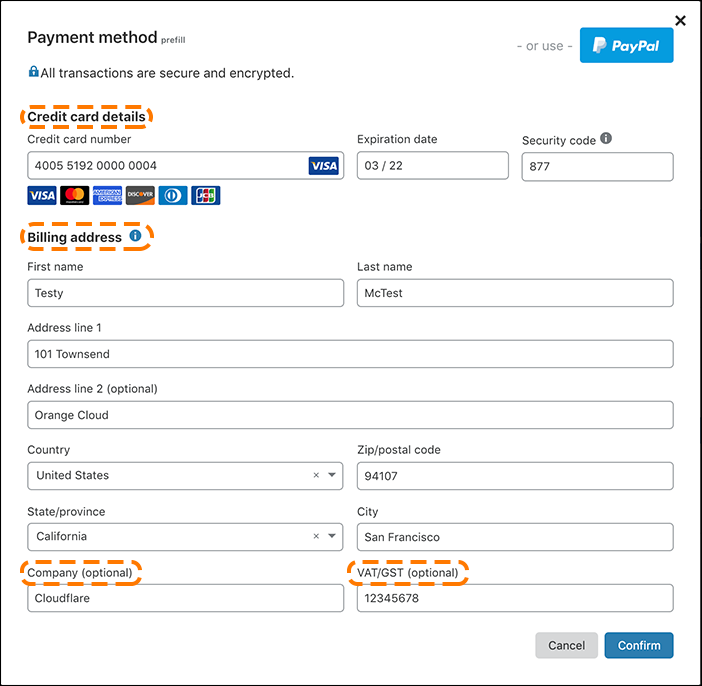

Updating Cloudflare Billing Information Cloudflare Help Center

Understanding Gst On Credit Card Transactions

Why Is Gst Applied If I Have An Emi On A Credit Card Even Though Interest Is Already Being Charged By The Bank Quora

Get Amazing Services By Our Professionals Of Gst Suvidha Center Credit Card Services Tax Services Personal Loans

Gst Tariff For Credit Card Debit Card Charge Card Or Other Payment Cards Related Services

Myths About Impact Of Gst On Credit Cards

Gst Credit Card Bill Insurance Premium To Get Costlier Insurance Card Insurance Card Template Car Insurance

A Comprehensive Software To Manage All Your Gst Billing Compliance Needs File Your Gstr1 Gstr3b Now Filing Is Ju Tax Software Income Tax Return Income Tax

Credit Card Surcharges Gst Generate Accounting

Highlights The Government On Friday Has Increased The Gst Collection Targets For The Month Of January And February By Rs 1 Instant Loans Target Government

Sbi Is Gst Ready Goods And Services Tax Can Be Paid Digitally Through Our Internet Banking Or Debit Card All Our 2 Banking Debit Cards Goods And Service Tax