My REIT exposure is Fidelity Real Estate Investment Trust Premium I bought the minimum 10000 and it has promptly lost 11 YTDso I have 8900. Follow these 4 investing rulesignore the rest.

The price is WAY too high.

5 rules of thumb on m reit investing. Learn more about REIT risks and if REITs are safe. And Arbor Realty preferred shares yield 818 another 10000. And Hybrid REITS contain a mix of both equity and mortgage investment strategies.

25 which in TCOs case is a historic low. If you need help choosing the right investment property for your needs give us a call at 8886573033. The way it works is that in Singapore while the dividend yield can range from as low as 0 to as high as 7-8 for REITs I find that the yield on a portfolio typically comes up to around 4-5.

While this is in the Singapore context the same rule can be modified to suit your local market conditions. The real estate investment trust REITwas originally intended to be a mutual fund for real estate. Still there are risks.

The average worker may replace 85 percent of his pre-retirement income by saving at least 8 times his ending salary. If we use 7 for TCO to take another tack. My other real estate bet is Ashford Hospitality Trust preferred shares yield 839 Another 10000.

A related investment rule is to focus on total price returns. In order to feel safe a REIT must be well-covered by earnings or in REIT world we call it Funds from Operations and the management team must be committed to maintain and increasing the. A firm with an earnings yield of 5 that pays no dividend would need a ratio of earnings retained to book value of at least 20 to qualify with the desired score.

REITs have risk and so have traditionally give investors something. We wanted to expand on that idea and make a more investing-specific list with useful rules of thumb for the everyday buy-and-hold ETFindex fund investor. The original REIT legislation enacted in 1960 was intended to provide a tax-favored vehicle through which the average person could invest in a professionally managed portfolio of real property.

Follow these five rules of thumb and youll be able to make an educated analysis on investment properties in Plano property management. A REIT will be closely held if more than 50 percent of the value of its outstanding stock is owned directly or indirectly by or for five or fewer individuals at any point during the last half of the taxable year. Many people over the years have asked Jack Bogle about his portfolio hoping to divine the perfect investment mix.

Like a 6 to 8 dividend. Equity REITs primarily own and operate real estate related assets multi-family office industrial hospitality data storage centers etc. The three ratios are highly interrelated.

Heres yet another retirement rule-of-thumb this time by Fidelity Investments. This is commonly referred to as the 550 Test. In order to reach the 8X level by age 67 Fidelity suggests workers have saved about 1 times their salary at age 35 3 times at age 45 and 5.

The complex rules governing REITs are all meant to. Over at Get Rich Slowly posted 25 Useful Financial Rules of ThumbThese guidelines are designed to help everyday people do more with their finances. Mortgage REITs generally provide financing directly to real estate owners and operators or hold mezzanine debt.

From a dividend point of view a REIT should throw off a lot more than. REITs are a great way to invest in real estate without having to own and manage property. Rule of 72.

Put away at least 3-6 months worth of expenses in a liquid savings account to ensure it. For instance a quick glance at the performance of PHK over the last 5 years will scratch it off the list of investors who use this. The emergency fund rule.

This is a neat little rule that states that you can expect returns of 10 from equities 5 from bonds and 3 on liquid cash and cashlike accounts. Unlike the 100 shareholder requirement attribution rules under section 544 modified. The 10 5 3 rule.

The Rule of Thumb screen totals earnings yield earnings retained to book value and dividend yield and looks for companies with a high value. I failed to follow this rule with Electro Energy this January and optimistically put in an order to sell 40 of my holdings at 25 times my purchase price 130 but the stock peaked in. That should tell you that.

Not too long ago JD.

Six Of The Most Luxurious Bay Area Homes Are Up For Auction Simultaneously Expensive House Expensive Houses Real Estate

:max_bytes(150000):strip_icc()/shutterstock_210931240-5bfc3d85c9e77c00514868a9.jpg)

Real Estate Investment Trust Reit Definition

How To Deal With Zakat On Your Investments 2020 Update Ifg

26 Smartest Ways To Invest Your Money During The Pandemic

Rule Of 72 What Is The Formula And Why Does It Work Thestreet

Https Www Jstor Org Stable 27802670

Redo It Yourself Inspirations Horsing Around Worn Horseshoes Ideas Wooden Coat Rack Horseshoe Decor Horseshoe Crafts

Real Estate Investment Trust Reit Definition

Can I Afford A House Dave Ramsey Secret To Saving More House Cost Saving Tips Ramsey

The 5 Rules Of Money Moneybyramey Com Budgeting Money Finance Infographic Money Management

Dave Ramsey S 4 Mutual Funds Explained Shawn Roe Dave Ramsey Mutual Funds Mutuals Funds Dave Ramsey

How To Deal With Zakat On Your Investments 2020 Update Ifg

Dave Ramsey S 4 Mutual Funds Explained Shawn Roe Dave Ramsey Mutual Funds Mutuals Funds Dave Ramsey

Rental Property With 6 Cap Rate Vs Reit With 8 Return Blog Spanish Verb Spanish Verb Conjugation Conjugation Games

Pin On Finance Tips To Retire Early Early Retirement

Business With Zero Investment Money Management Advice Business Advice Business Rules

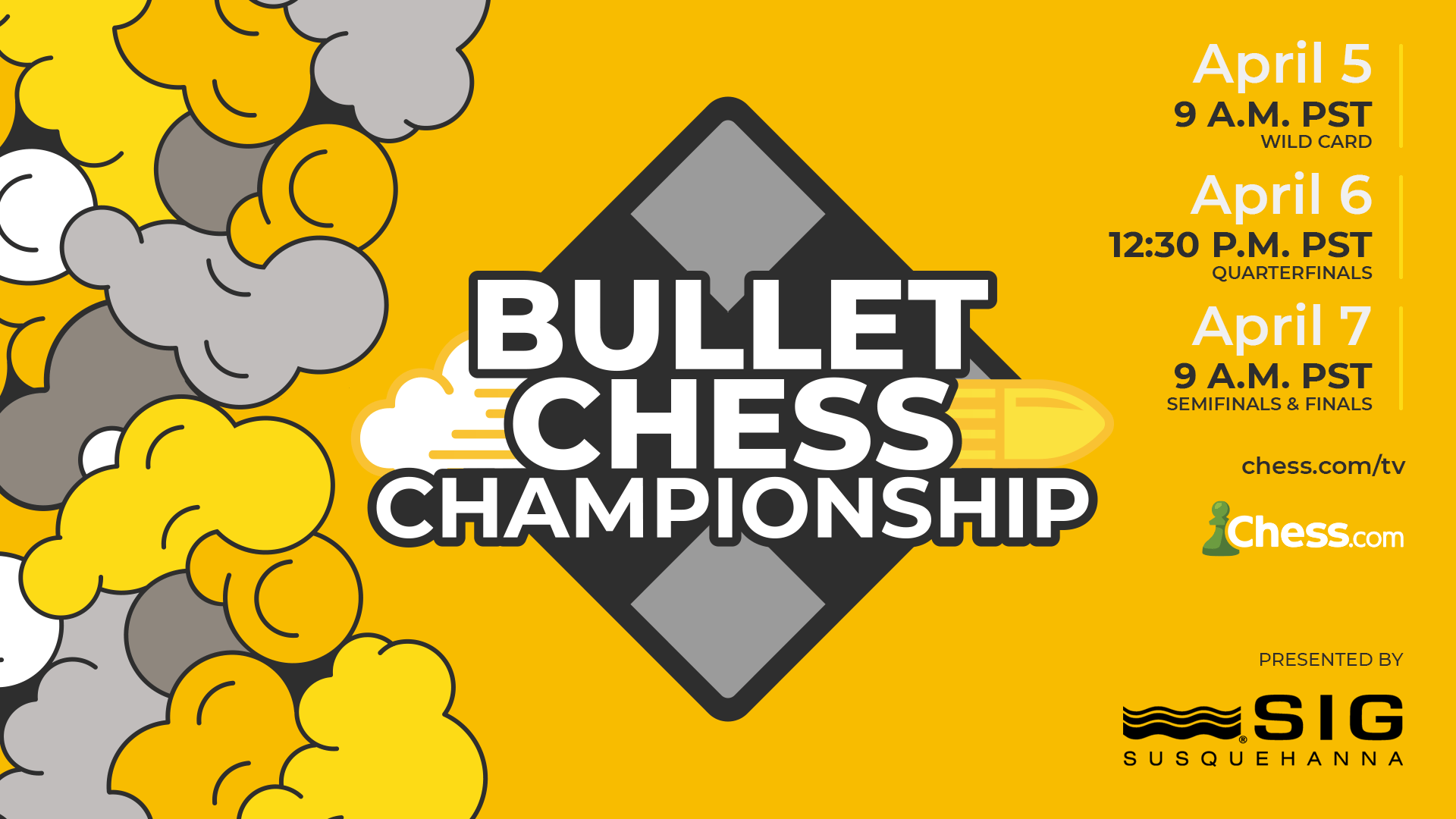

2021 Bullet Chess Championship Presented By Sig Erigaisi Artemiev Hansen Nihal Through Chess Com