A fund manager manages the unit trust or fund. Tax law or whether it is a business entity.

Know About Tax On Mutual Fund And Taxation Rules Mutual Funds Investing Mutuals Funds Investing

A trading trust broadly a trust that carries on activities other than holding solely passive investments such as shares land and fixed interest assets.

Unit trust how to classified as. Some investment products are categorised as Specified Investment Products SIPs. Under Division 6C of Part III of the Income Tax Assessment Act 1936 ITAA 1936 a public trading trust PTT must be both. Do check with your financial institution whether the product you are considering is an SIP.

For unit trust investment an investor must be a sophisticated investor before heshe is qualified to invest in a fund categorized as a wholesale fund under the guideline issued by Securities Commission of Malaysia SC. The price of a unit will be. Unit Trust How to classified as Sophisticated Investors.

A unit trust fund is a way for you to invest your money. Unit trusts may have corporate trustees to limit any liability incurred by the trustee to that corporate entity and protect the assets of the unit trust. A unit trust is a type of collective.

A unit trust fund is a pooled resource which means that it allows a. To be clear Unit trust is just an investment structure it is not an investment strategy itself. You give the money to a trustee often a big financial institution and the managers fund house manage the money for you a promise.

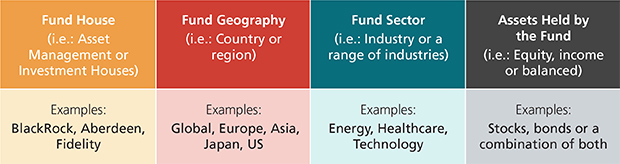

Funds are classified in two broad tiers the first geographical the second the type of investment based on asset class. Unit trusts treated as corporate entities Public trading trusts. Furthermore unit trusts are predominantly governed by their unit trust deed which establishes the trust.

Unit Trust investment starts with a broken promise. An Investment Management Company or a bank. Certain unit investment trusts generally where there is an ability to vary the investments are not considered trusts for US tax purposes.

Trusts may be classified by their purpose duration creation method or by the nature of the trust property. These investment trusts are treated in the same manner as a traditional business entity under the rules discussed above ie. A unit trust is a trust where the rights of the beneficiaries unit holders to income and capital are fixed.

Unit Trust ETF or REITs are all under the trust structure. If you need help navigating the U-Online feature contact our friendly Customer Service Representatives 1-868-625UNIT Options 1 to 4 daily between the hours of 700 am. Unit trusts pool the resources of investors into one large fund which is then divided into shares or units.

You can invest in a unit trust fund through financial services providers such as a broker. They are paid a management fee from the fund typically based on a percentage of the assets they manage. Unit trusts are managed by professional fund managers and have varying levels of.

The term unit trust is also used in the United Kingdom UK as a mutual fund which has different properties than mutual funds in the United States. You will need to be certified to invest in them. For those arrangements classified as a trust a determination must be made as to whether the trust is a domestic trust or foreign trust.

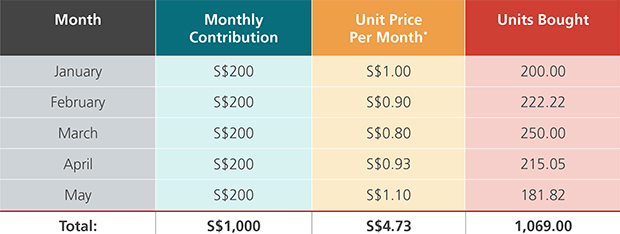

What is less mentioned is the term Fund Volatility Factor FVF. As such returns are dependent on the NAV fluctuation of a unit trust fund and thus are not guaranteed. When an investment in an associate or a joint venture is held by or is held indirectly through an entity that is a venture capital organisation or a mutual fund unit trust and similar entities including investment-linked insurance funds the entity may elect to measure investments in those associates and joint ventures at fair value through profit or loss in accordance with IFRS 9.

If you are already using our U-Online service you can contact our CSRs via the secure email feature. It is based on the net asset value NAV appreciation of a unit trust fund over a specific period of time. The NAV does not represent the price you will pay for a unit in a unit trust.

It is a measure of capital growth over cash returns. One common way to describe trusts is by their relationship to the life of their creator. Necessary to classify the entity and the process for determining whether the entity qualifies as a trust under US.

This is in the sense that they are not subject to any discretions on the part of a trustee and are unitized in the sense that those rights are divided amongst the beneficiaries based on how many units have been issued to them. Those created while the grantor is alive are referred to as inter vivos trusts or living trusts. To find out the NAV you divide the value of the assets by the number of units already in use so 10000050000 2.

The election is made. This means that the NAV is 2. A third tier provides narrower sub-categories see diagram below.

Quicken Home Business Budget Software Personal Finance Budget Personal Finance

Best Time To Invest Is Now In 2021 Mutual Funds Investing Finance Investing Investing

Types Of Mutual Fund Mutuals Funds Finance Investing Life Insurance Marketing Ideas

Other Than Asset Class How Else Can One Classify Mutual Funds Schemes Amfi Mutual Funds Investing Mutuals Funds Investment In India

What Is Unit Trust Investment Dbs Singapore

Pin On Ebecore Com 1410117 22167712648

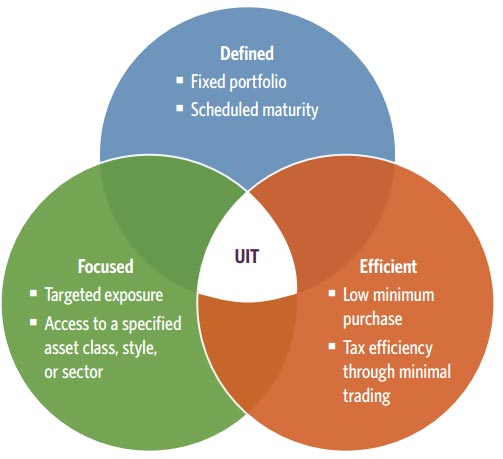

Unit Investment Trust Uit Definition

About Unit Investment Trusts Uit Guggenheim Investments

Won T I Need A Large Amount To Invest In Mutual Funds Mutuals Funds Mutual Funds Investing Investing

Unit Trust Investment Sharetrading Tax Free Offshore Investments Sanlam

What Is A Balanced Mutual Fund Mutuals Funds Credit Score What Is Credit Score

Understanding Distribution Of Income By Unit Trust Funds

Understanding Distribution Of Income By Unit Trust Funds

What Is Unit Trust Investment Dbs Singapore

Day 6 Design In The Historic Environment Gilfach Y Berthog Site Plan Sketch Plan Sketch Architecture Analysis

/141251781-5bfc2b9646e0fb00517be167.jpg)