According the 2015 Budget government proposes to increase personal income tax rates by one percentage point for all taxpayers earning more than R181900. It is this MAY 2017 Budget Regulation to the FIRB ruling which will enable developers to build terraces townhouses.

Australia Property Market Housing Market Predictions 2021 Rent Prices Sydney Melbourne Brisbane Hobart Managecasa

This is partly due to Covid locking down the construction industry but total housing output across both the public and private sector is just 17000 units according to the SCSI.

Budget 2014 property sector hit hard by. The property and sin sectors are likely to be losers in the much-anticipated Budget 2014. Out of the 3 tightening rules forecast by Finance Malaysia 2 already Bingo. Property Sector Hit Hard by RPGT and DIBS ruling.

Budget 2014 Data from the Estimates of Appropriations 201415. Budget and the property sector. Out of the 3 tightening rules forecast by Finance Malaysia.

Many are expecting a slew of changes to curb property speculation such as the. As widely expected property sector would be one of the hardest hit sector in view of the proposed cooling measures to be imposed. Posted on July 16.

Property Sector Hit Hard by RPGT and DIBS ruling As widely expected property sector would be one of the hardest hit sector in view of the proposed cooling measures to be imposed. However properties valued over R225 million will see an increase of transfer duty to 11 from 8. Budget and Impact on the Property Sector.

Budget 2014 contained a number of announcements that will impact the property sector. Were FOREIGN PROPERTY BUYERS really hit hard in the Scomo Budget. Budget 2014 will hit hard to local property industry We think the approach is too hard even though we do not agree to sky rocketing propertys prices.

September 21 2019 September 22 2019 caa4nsw. Property Sector Hit Hard by RPGT and DIBS ruling As widely expected property sector would be one of the hardest hit sector in view of the proposed cooling measures to be imposed. Budget also introduced the new scheme called Beti Bachao.

Property Sector Hit Hard by RPGT and DIBS ruling October 27 2013 Get link. The Budget saw the Chancellor announce some welcome measures for the real estate sector including reliefs and stimuli designed to encourage investment and construction activity by SMEs in particular. South Australian property owners were slugged in the 201415 State Budget by a sharp increase in the Emergency Services Levy ESL paid on all property.

Buyers of GBI- certified buildings bought from property developers are eligible for stamp duty exemption on instruments of transfer or ownership of these buildings. This is applicable to new and upgrading of existing buildings. Out of the 3 tightening rules forecast by Finance Malaysia 2 already Bingo.

As widely expected property sector would be one of the hardest hit sector in view of the proposed cooling measures to be imposed. Extension of the Annual Tax on Enveloped Dwellings ATED capital gains tax and 15 SDLT rate to residential properties over 500000. The proposal is effective for buildings awarded with GBI certificates from Oct 24 till Dec 31 2014.

The root is whether it is speculative or other reasons that caused the price hike. Out of the 3 tightening rules forecast by Finance Malaysia 2 already Bingo. Budget 2014 contained a number of announcements that will impact the property sector.

The good news for residential property buyers is that the duty-free threshold for property transfers has been raised from R500000 to R750000. Extension of the Annual Tax on Enveloped Dwellings ATED capital gains tax and 15 SDLT rate to residential properties over 500000. Budget 2014-15 and its Impact on Various Sectors.

Affordable housing remains a thorny issue but the chorus of calls for more transparent information on property prices and values grows louder. All eyes are on next Fridays Budget 2014 announcement which many predict will have a big impact on the property industry. Limit in investments under 80C from Rs 1 lakh to Rs 15 lakh and interest on housing loan from self occupied property from Rs 15 lakh to 2 lakh.

Budget 2020 hardly has anything for the property sector as it includes existing programmes he said during a panel discussion at the Post Budget 2020 Forum that was organised by Malayan Banking Bhd CGS-CIMB Securities Sdn Bhd and RHB Banking Group yesterday. Leary Partners quantity surveyor and tax law expert Kaylene Arkcoll forecasts a bleaker future for investors in Australias residential property -- particularly strata unitsThe budget has stripped investors buying second-hand residential prop. In addition several Government consultation documents are awaited that could lead to further future changes.

In addition several Government consultation documents are awaited that could lead to further future changes. However there was more bad news for non-residents and those holding UK property in enveloped structures. South African consumers and marginal commercial property tenants will come under further financial pressure due to proposed tax increases in the 2015 Budget.

Housing Market Archives Norada Real Estate Investments

The Unassuming Economist Balancing Financial Stability And Housing Affordability The Case Of Canada

Rental Housing Market 2021 Will Rent Prices Rise Or Fall In 2022 Managecasa

The Unassuming Economist Housing Market In Finland

Beyond Proptech How Technology May Change Construction And The Real Estate Industry By Pablo Martinez Almeida Medium

China S Indebted Residential Property Development Sector Seafarer Funds

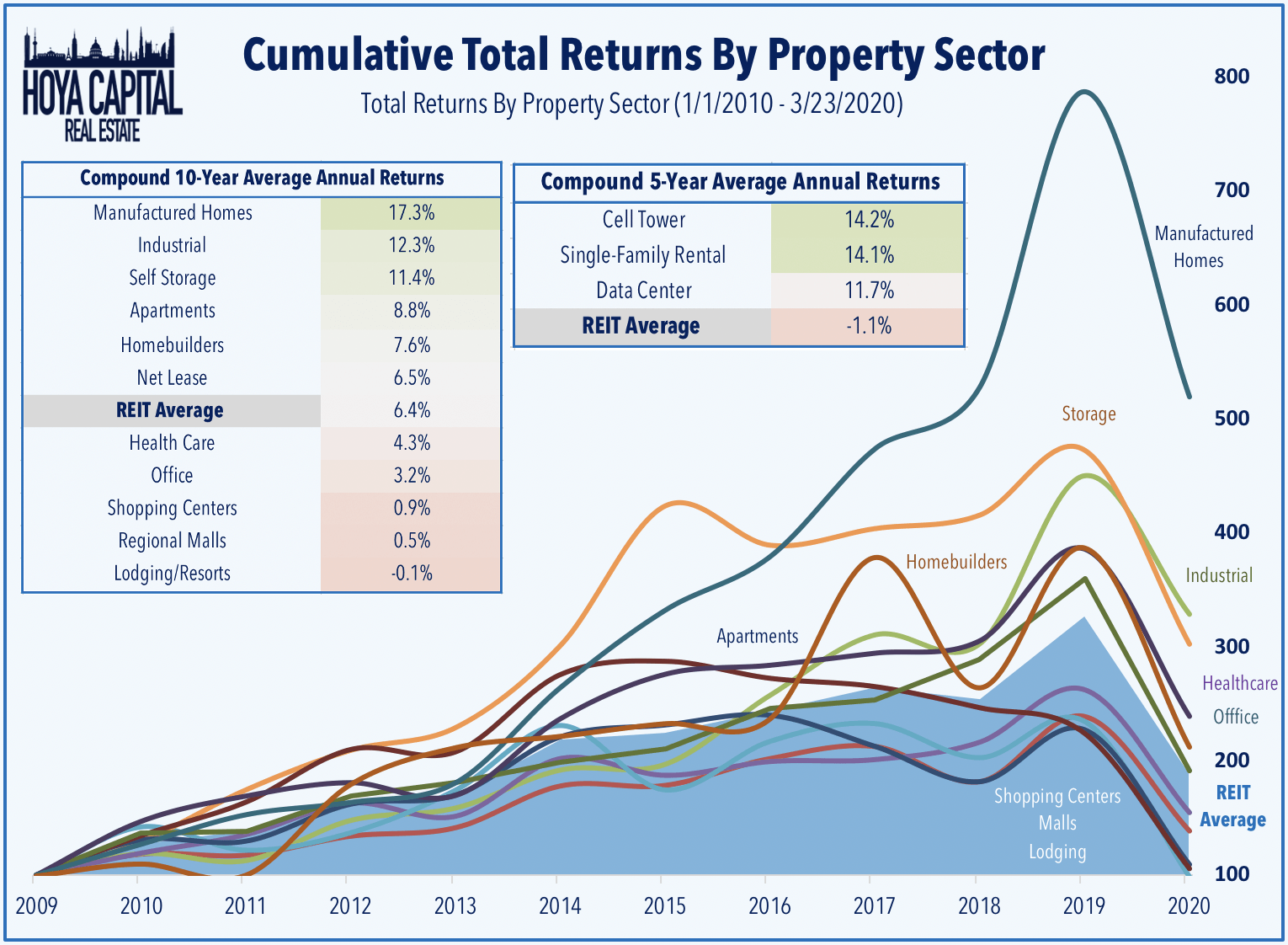

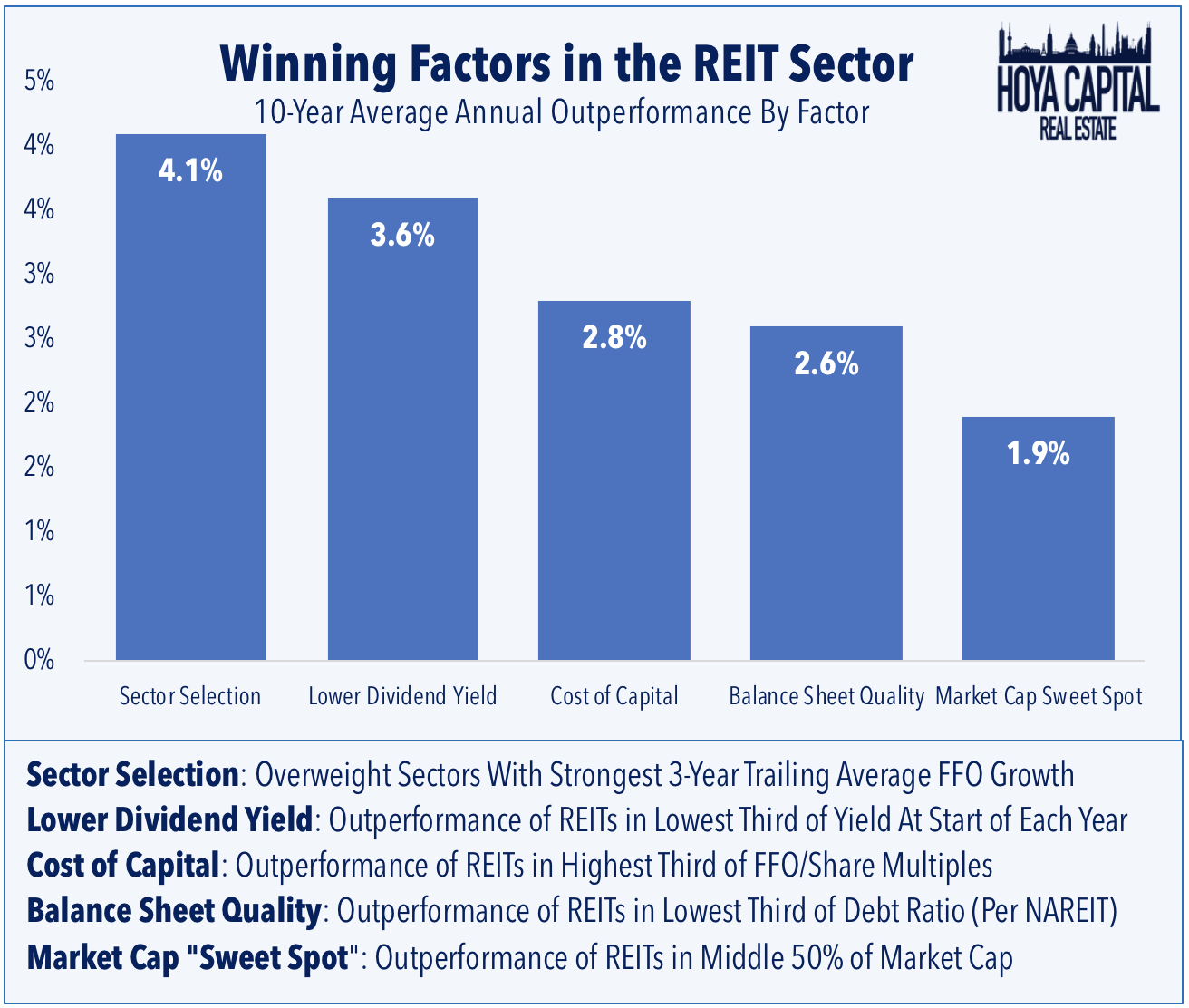

Cheap Reits Get Cheaper Seeking Alpha

The Unassuming Economist Housing Market In Finland

Rental Housing Market 2021 Will Rent Prices Rise Or Fall In 2022 Managecasa

China S Indebted Residential Property Development Sector Seafarer Funds

The Unassuming Economist Housing Market In Singapore

Rental Housing Market 2021 Will Rent Prices Rise Or Fall In 2022 Managecasa

High Yield Reit Cefs And Etfs No Free Lunch Seeking Alpha

The Unassuming Economist Understanding Singapore S Housing Market

Housing Market Archives Norada Real Estate Investments

Australia Property Market Housing Market Predictions 2021 Rent Prices Sydney Melbourne Brisbane Hobart Managecasa

How Covid 19 Could Drive Esg Adoption In The Real Estate Industry

Australia Property Market Housing Market Predictions 2021 Rent Prices Sydney Melbourne Brisbane Hobart Managecasa